OUR DEFINED BENEFIT TRANSFER SERVICE

If you are reading this page you may be thinking about retiring and have reached a crossroads. You are lucky enough to have accrued benefits in a defined benefit scheme but are now unsure about what you should do next?

Do you opt for the security of a guaranteed pension for life, or do you take the risk and transfer to a personal scheme?

To answer this question, you will need professional advice, and this is where we come in.

Our starting position is that most people will be better off by not transferring their pension. You should therefore think very carefully about your situation and the risks involved before seeking advice.

More information about our DB advice services can be found in our publication titled ‘A Guide to SRC’s DB Transfer Service’, to request a copy, please call 01268 280096 or email info@srcfinancial.com

Our Advice Criteria

Unless your circumstances are exceptional, you must meet our criteria before we will enrol you in our transfer advice service.

Our criteria for advice:

- at least 53 years old and considering retiring within the next 2 years

- transfer value of £500,000 or more

- resident in the UK

Ideally you will also identify with one or more of the following statements:

- I want to retire now

- I have other assets to support me during retirement e.g. other pensions, investments, savings

- I have a clear idea why a transfer may be suitable for me

- I have some experience of investments and their associated risks

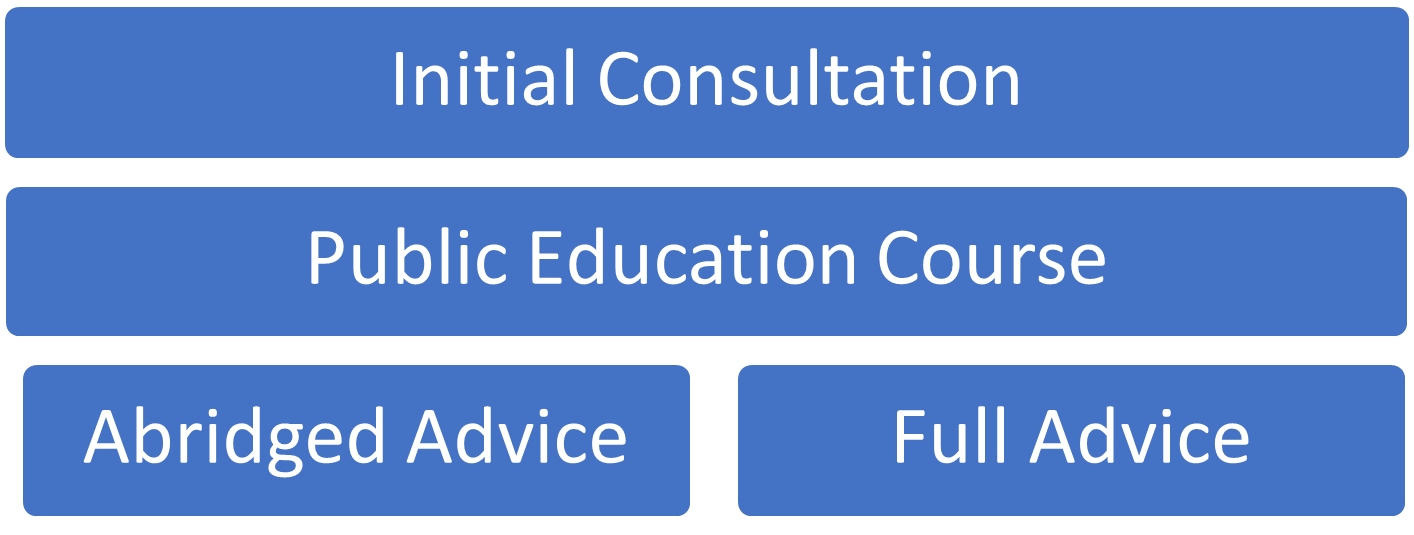

An overview of our DB transfer service

There are four elements to our DB advice service.

If you meet our criteria we will invite you to attend an initial consultation. We will assess your situation and will recommend which of our advice services may be right for you.

However, before you can access either of our advice services, you will need to complete our public education course. We will explain more about this when we meet.

Abridged Advice normally takes between two to three weeks to deliver, whereas the timescale for Full Advice can be six weeks or more (depending on the complexity of your situation). Please bear these timescales is in mind if you have already obtained a transfer value.

You will receive a personalised quote confirming how much we will charge you for advice before we start advising you.

The Initial Consultation

The initial consultation is a relaxed meeting that affords you the opportunity to ask lots of questions about us and our DB transfer services.

We will explain in detail how Abridged Advice and Full Advice works, as well as providing information about our ongoing advice service.

We will talk to you about the risks of transferring to ensure that you have a basic understanding of the risks involved.

Please note that it will not be possible for us to make a recommendation to you at this stage, we will however confirm which service we think is suitable for you.

Public Education Course

We have teamed up with Money Alive to provide consumers with access to an online educational course. It is run independently from us and aims to provide a basic overview of DB schemes and the risk associated with transferring.

After the initial consultation we will send you a personalised advice quote that will contain an email link to the Money Alive website. You must complete the course before you can progress to either our Abridged Advice or Full Advice services.

The course is free of charge and there is no time limit to complete it. You must complete the course before you can progress to either our Abridged Advice or Full Advice.

Abridged Advice

Our Abridged Advice service will determine whether you should keep your DB scheme without considering a new scheme

We will need to know about you, your family, your expenditure and financial needs, your plans and retirement goals.

We will consider any other assets you have to meet these goals and talk to you about financial risks, including asking you to complete a pension transfer risk assessment and investment risk questionnaire.

At this end of this stage you will receive a report, confirming one of two outcomes, either:

1. Your existing arrangements are suitable, and we recommend you do not transfer, or,

2. Your situation is unclear, and Full Advice is recommended

Please note that Abridged Advice is not classified as transfer advice, we are not therefore able to sign the ceding scheme advice declaration.

Please note that Abridged Advice is not classified as transfer advice, we are not therefore able to sign the ceding scheme advice declaration.

Full Advice

Our Full Advice service will provide a comprehensive analysis of your DB scheme and an alternative private arrangement that may be suitable for your needs. This will include detailed cashflow modelling of possible financial outcomes allowing for all your assets. We will also consider if there are other ways of meeting your objectives without giving up your DB scheme.

We will write a report confirming whether we think you should keep your DB scheme or transfer. The report will explain why we think our recommendation is right for you whilst making you fully aware of the advantages and disadvantages.

It is possible that we may recommend you do not transfer at the end of the process. Please remember that our initial advice fee is payable even if you do not transfer.

It is possible that we may recommend you do not transfer at the end of the process. Please remember that our initial advice fee is payable even if you do not transfer.

Our Fees

You will receive a personalised quotation prior to us commencing work.

| Our Fees | |

| Initial Consultation | Free |

| Consumer Education Course | Free |

| Abridged Advice | £1,400 |

| Full Advice | 1% of CETV |

Our fees are not currently subject to VAT.

Fee Breakdown:

Example of Fees for advice on a CETV of £650,000

Abridged Advice (advice not to proceed):

Full Advice (unclear from abridged advice whether it is suitable to remain in the scheme):

| Our Fees | |

| Consumer Education Course | Free |

| Initial Consultation | Free |

| Abridged Advice | £1,400 |

| Full Advice (1% of CETV) | £6,500 |

| (Less Abridged Advice) | (£1,400) |

| Total Fee: | £5,100 |

It is possible for our advice fees to be paid from the transfer value, but you should not rely on this as transferring may not be recommended.

Ongoing Advice

If you transfer your pension, we will strongly recommend that you receive ongoing advice.

Ongoing advice is not mandatory, and you are free to opt out of this service at any time.

SRC Ongoing Advice - 0.65% of money under advice

Ongoing Advice Example - £650,000 CETV

Annual fee - £352 per month (£4,225 per annum)

FCA GUIDANCE ON DEFINED BENEFIT TRANSFERS

To learn what the FCA has to say about defined benefit transfer advice and the service you should expect please click on this link https://www.fca.org.uk/consumers/pension-transfer